are hoa fees tax deductible in california

In general HOA fees are not tax deductible in California. In general HOA fees are not tax deductible in California.

California Hoa Condo Tax Returns Tips To Stay Compliant Template

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. In other words hoa fees are deductible as a rental expense. However there are special cases as you now know.

So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you. Are HOA fees paid on a rental property tax deductible. Because the IRS views the cost of an HOA cost to be a necessary price for keeping the home any residential or commercial property used as a rental building is eligible for a tax.

The due date is. As a general rule no fees are not tax-deductible. But the profit is taxed at the 30 rate as compared to the corporate tax that starts at 15.

Your HOA may need to file a state homeowners association tax return depending on the location you are in. However if you have an office in your home that you use in. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

When it comes to state taxes the laws differ from state to state. As a homeowner it is part of your. Tax-exempt organizations and unincorporated Homeowners association are not subject to the minimum franchise tax.

The IRS considers HOA fees as a rental expense which means you can write them off from your. Year-round residency in your property means HOA fees are not deductible. The IRS views them as personal expenses not a tax rendering them ineligible as tax deductible.

You can claim the HOA fees as a tax deduction because the costs are an expense you have to incur to maintain the property even though you arent the owner. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Filing your taxes can be financially stressful.

HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. Estimated tax payments may be required. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600.

Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. The IRS considers HOA fees as a rental expense which means you can write them off from your. There are many costs with homeownership that are tax-deductible such as your mortgage interest.

What Is A Homestead Exemption California Property Taxes

Are Hoa Fees Tax Deductible In California Hvac Buzz

Do All Condos Have Hoa Fees Quora

Are Homeowners Association Fees Tax Deductible

Hoa Fees Definition How They Affect You Financially Zeromortgage

What Are Hoa Assessments Are Homeowners Obliged To Pay Hoam

Are Hoa Fees Tax Deductible Clark Simson Miller

How Are Taxes On Rental Property Income Handled

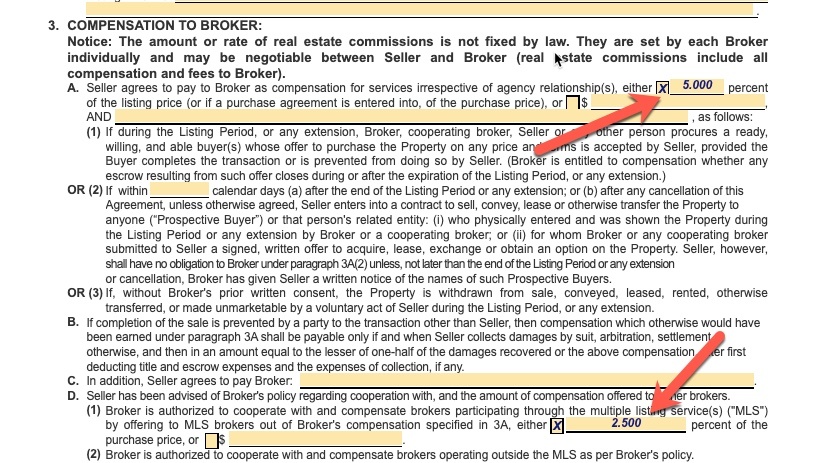

How Much Are Seller Closing Costs In California

Most Hoa Fees In Southern California Are 400 1000 Per Month For A 2 Bed Two Bath Condo Why Are Hoa S 2000 5000 In Manhattan Quora

Closing Costs For Buyers In California Houzeo Blog

Hoa Fees And Property Taxes Explained

What Are Homeowners Association Hoa Fees Freedom Mortgage

How Many Ca Taxes Fees Can You Identify I E Staying At A Hotel In Sf Ca I Counted 8x Fees And Taxes Assessed Every Night On My Bill What About When

How To Reduce Hoa Fees Experian

Closing Costs For Buyers In California Houzeo Blog

Hoa Tax Return The Complete Guide In A Few Easy Steps Template